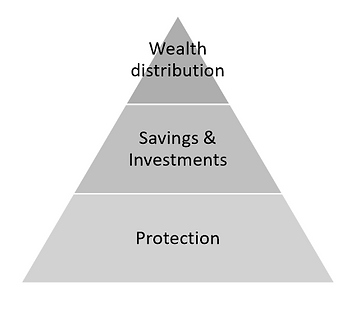

We Protect | We Invest | We Distribute

learn the secret of a Millionaire:

Financial Adviser

A mansion overlooking the ocean, a collection of luxury cars, purchasing anything to everything without worrying about its price; if there is one goal in life that is oblivious to the distinctions of race, religion, and geographical location, it’s to be abundantly wealthy: A Millionaire.

However, achieving millionaire status is as good as praying for money to rain down from the sky if one does not forge a determination to shed old habits and mindset, and the discipline to do something about it.

For those who want to realise their dream of becoming a millionaire, it is not entirely far-fetched.

How do I become a millionaire?

“You can’t have a million dollar dream with a minimum wage work ethic.“ ― Stephen C. Hogen

To be frank, the process of becoming a millionaire is simple, but not easy. Just like how the answer to becoming fit is simple: healthy diet and exercise, but not easy.

The very first decision you must make is to consciously decide to manage your personal finance and become your own financial planner. The most important realisation is that to become a millionaire, you’ve got to become your own financial planner.

But why even is becoming your own financial planner important?

For better or worse, money touches all areas of life. And Financial Literacy can definitely help.

Financial literacy is important because it equips us with the knowledge and skills we need to manage money effectively. Without it, our financial decisions and the actions we take—or don’t take— lack a solid foundation for success.

To put it simply, Financial literacy involves being proficient with financial principles and concepts, such as financial planning, compound interest, managing debt, profitable savings techniques, and the time value of money etc.

And according to the 21st edition of its Malaysia Economic Monitor,

• 60% of bankrupt borrowers were within the age group of 25 to 34.

• About 40% of millennials admitted to spending more than they can afford.

• 60% of Malaysian adults were not covered by the EPF, adding that although more than 89% agree that their EPF savings were insufficient, only 38% have started planning for retirement.

• High rates of bankruptcy because of borrowing for consumption rather than for wealth accumulation.

You might think that you’re definitely not part of such absurdity. And yet so many Malaysians lack the financial discipline and humility: purchasing an IPhone 11 Pro on instalment to fit in; buying a bigger house than you can afford; struggling to pay off your 8-series BMW car loan; going on expensive holidays when you barely have any emergency funds. Sometimes, the worst financial mistakes are the ones that slowly eat away at your wealth.

It’s been found that Malaysians have low confidence regarding their own financial knowledge. 1 in 3 Malaysians rate themselves to be of low financial knowledge. 75% of Malaysians understand that inflation means that cost of living is rising, but only 38% can relate the effect of inflation on their own purchasing power.

This is a major concern. Financial illiteracy contributes to people making poor financial decision and causes many to become victims of predatory lending, subprime mortgages, fraud, and high-interest rates, potentially resulting in bad credit, bankruptcy, or foreclosure.

Given so, you should see clearly that if you don’t become your own financial advisor and achieve financial literacy, the idea of achieving financial freedom would be absurd, let alone becoming a millionaire.

Financial Planning Basics

Protection

Protection in financial planning simply means insurance. Buying insurance is the very foundation of a strong financial plan, because it ensures that you are financially secure to face any type of problem in life.

Insurance differs in their purpose, coverage and premium.

Hence, it would be wise to have some awareness on your own personal insurance needs before seeking professional guidance.